Health Insurance Coverage for Car Accidents: What You Need to Know. Discover how health insurance covers car accidents. Learn what To expect. From medical bills To claims, & ensure you’re protected when it matters most!

What is Health Insurance Coverage for Car Accidents: What You Need To Know & how does it work?

Health insurance coverage for car accidents provides support for medical expenses arising from collisions. Coverage typically handles hospital visits. Surgeries, & rehabilitation costs. Policies may include accident-specific clauses. Guaranteeing assistance when needed. Understanding your plan helps you navigate your options effectively. Always check limits on coverage & associated deductibles.

Brief history of Health Insurance Coverage for Car Accidents: What You Need To Know

Health insurance coverage for car accidents evolved over decades. Early provisions mainly offered minimal support for injuries. Over time. Reforms led To broader protections in policies. Insurers began recognizing rising accident rates & escalating medical costs. Now. Most plans include extensive accident coverage. Demonstrating significant advancements.

How To implement Health Insurance Coverage for Car Accidents: What You Need To Know effectively

Implementing coverage starts with choosing a suitable plan. Review different options from various providers. Compare features. Pricing, & benefits before making decisions. Understand coverage limits & exclusions clearly. Ensuring you select what best fits needs. Consult experts when necessary for personalized advice & ensure all documentation remains in order.

Key benefits of using Health Insurance Coverage for Car Accidents: What You Need To Know

Many advantages come with utilizing health insurance for accidents. Coverage alleviates financial burdens from sudden medical expenses. You gain access To quality care without devastating out-of-pocket costs. Mental health support may also be included. Addressing emotional challenges post-accident. Having this coverage instills confidence when driving. Knowing you’ve protected yourself.

Challenges with Health Insurance Coverage for Car Accidents: What You Need To Know & potential solutions

Several challenges may arise regarding health insurance for accidents. Confusion often occurs over policy details & exclusions. Some individuals face difficulty understanding claims processes. Leading To frustration. Inadequate coverage may also result in high out-of-pocket expenses. Solutions include improved education from insurers & engaging customer service more effectively.

Future of Health Insurance Coverage for Car Accidents: What You Need To Know

Future trends suggest continued growth in health insurance coverage for accidents. Increased awareness around mental health can lead insurers towards improved benefits. Advances in telemedicine may alter how care becomes accessed following accidents. More personalized plans could emerge. Catering specifically for diverse needs. Insurers might also adapt regarding legislative changes in this field.

Table of Health Insurance Coverage for Car Accidents: What You Need To Know

Below is a summary highlighting essential elements. Features, & coverage types:

| Coverage Type | Details |

|---|---|

| Emergency Medical Care | Covers immediate treatment following an accident |

| Rehabilitation Services | Assists with physical therapy & recovery |

| Mental Health Assistance | Provides support for emotional trauma |

| Long-term Care | Covers ongoing medical needs after severe injuries |

Understanding Health Insurance Coverage

Health insurance coverage for car accidents can vary greatly. Various factors impact how coverage applies. Including policy specifics. Therefore. Understanding details about coverage can empower individuals during difficult times. After a car accident. Navigating insurance can feel overwhelming. Essential details help alleviate concerns during recovery.

Many people wonder, “Does health insurance cover car accident injuries?” This question has numerous answers. Depending on one’s specific situation. For comprehensive insights. Visit this article on health insurance & car accidents.

Types of Health Insurance Coverage

Health insurance comes in multiple forms. Categories include private insurance. Government programs, & employerprovided options. Each type plays a role in covering injuries sustained during car accidents. Knowing these distinctions can aid in assessing potential benefits while managing expenses.

Private health insurance often includes both HMO & PPO plans. HMO plans require using network providers. While PPO plans offer more flexibility in choosing doctors. Therefore. Understanding specific policy limitations. Copayments, & deductibles can lead To better financial planning. Government programs. Such as Medicaid & Medicare. Provide coverage To eligible individuals. They may cover injuries sustained in car accidents. Contingent on specific conditions.

Employersponsored health insurance typically falls between private & government plans. Employers may offer diverse plan options. Impacting coverage. Benefits may include comprehensive medical services. Rehabilitation, & prescription medications. Knowing specific terms ensures individuals understand their coverage options.

Health Insurance vs. Auto Insurance

Knowing differences between health insurance & auto insurance can prove invaluable. Auto insurance focuses on vehiclerelated damages & personal liability. Health insurance. However. Prioritizes medical expenses & health services. Both types serve distinct roles & can complement one another during recovery.

Auto insurance often includes personal injury protection (PIP). Which compensates medical expenses regardless of fault in an accident. This coverage may address certain medical costs. Rehabilitation services, & lost wages. Understanding how PIP works alongside health insurance enables individuals To maximize benefits.

Individuals lacking PIP might rely solely on health insurance for medical expenses. As such. This reliance requires careful examination of health insurance policies. Therefore. Being aware of specific exclusions ensures essential services are covered.

Coverage for Medical Expenses

Health insurance often covers various medical expenses following a car accident. Emergency room visits. Hospital stays, & surgeries usually qualify for coverage. Additionally. Followup appointments & physical therapy may also fall under covered expenses.

Understanding what constitutes covered medical expenses can prevent unnecessary outofpocket costs. Policies often specify deductibles. Copayments, & maximum coverage limits. Careful reviews of health insurance documentation are necessary for clarity in coverage.

Emergency medical services may include ambulance charges as well. These expenses become critical during emergencies. Making prompt medical attention vital. Therefore. Knowing how policies manage emergency services can foster better decisionmaking.

Rehabilitation & Recovery Coverage

Recovery from car accident injuries may require extensive rehabilitation. Health insurance often covers different rehabilitative therapies. Including physical & occupational therapy. These services help restore mobility & independence postaccident. Crucial for overall recovery.

Policies can vary regarding limits on rehabilitation sessions & associated costs. Thoroughly reviewing coverage provisions ensures individuals maximize available assistance. Understanding specialist requirements or referral processes also helps streamline rehabilitation efforts.

In certain cases. Mental health services may become necessary. Accidents can evoke emotional & psychological challenges. Many health insurance plans now include mental health resources. Crucial for holistic recovery. Confirming available mental health coverage fosters a comprehensive healing process.

Prescription Medication Coverage

Prescription medications often play a critical role in recovery. Health insurance typically covers medications prescribed for pain management. Inflammation reduction, & rehabilitation enhancement. Understanding how health insurance formulary works assists in obtaining necessary medications.

Coverage varies by insurer & specific plans. Regular checks on medication tiers can reveal preferred medications & associated costs. Many plans feature three tiers. Each with its own pricing dynamics. Therefore. Being aware of these tier levels can impact overall recovery costs.

Additionally. Utilizing generic medication options may lead To significant savings. Many insurers encourage generic usage due To lower costs. By favoring generics when possible. Individuals can manage expenses while ensuring proper medication access.

Limitations & Exclusions of Coverage

No health insurance plan covers every conceivable expense. Individuals must familiarize themselves with limitations & exclusions in their coverage. Some policies may exclude certain injuries or treatments related To car accidents. Necessitating due diligence.

Common exclusions include injuries resulting from driving under The influence or intentional harm. Additionally. Some plans might have waiting periods before specific services become available. Reviewing policy documents carefully empowers individuals during recovery.

Awareness of any caps on coverage amounts also becomes vital. Policies may impose limits on therapy sessions. Medication quantities, & associated costs. Knowing these restrictions enables individuals To strategize their treatment plans effectively.

Network Providers & OutofNetwork Care

Choosing healthcare providers impacts overall coverage & costs. Health insurance plans often establish networks of preferred providers. Utilizing innetwork providers usually leads To lower outofpocket expenses.

Going outofnetwork might incur higher costs. Some plans provide partial coverage when visiting outofnetwork providers. Creating challenges for individuals selecting specialists. Familiarizing oneself with The network can save significant money.

Moreover. Certain emergencies might dictate The need for outofnetwork care. Understanding how insurers manage these situations can assist in navigating unexpected circumstances. Therefore. Verifying emergency protocols before a car accident occurs can prove beneficial.

Policy Deductibles & Copayments

Most health insurance policies require deductibles & copayments. A deductible represents an amount clients pay before insurance kicks in. Knowing this limit influences financial planning during recovery.

Copayments are fixed amounts paid for various services. Different services may feature varying copayment amounts. Impacting overall treatment costs. Understanding how these factors interact becomes crucial for managing expenses effectively.

Policies may also feature outofpocket maximums. Which limit total annual costs for insured individuals. Familiarity with these figures helps individuals budget for healthcare more effectively. Therefore. Knowing how deductibles & copayment structures work can lead To smoother recovery.

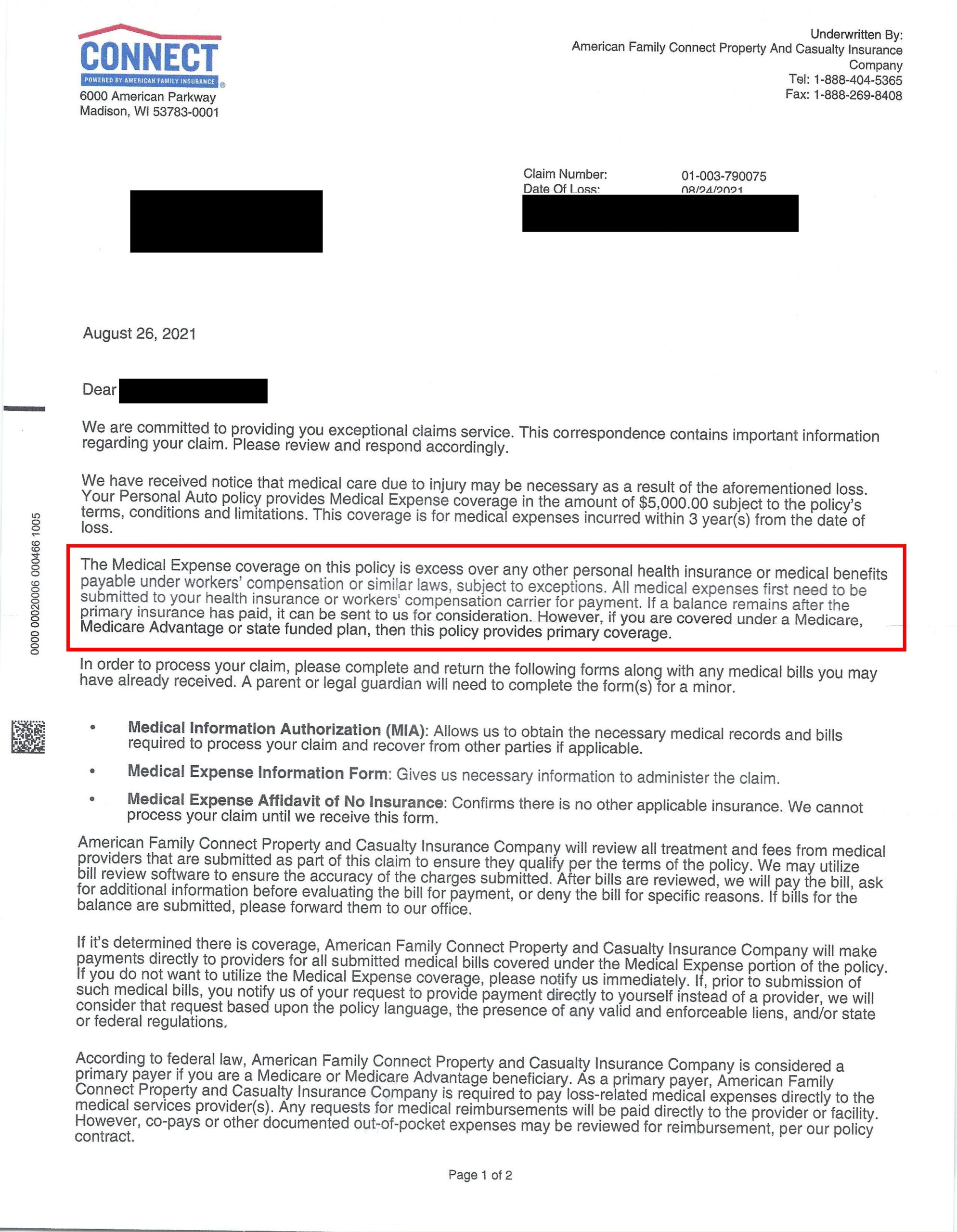

Coordination of Benefits

Coordination of benefits occurs when individuals have multiple insurance policies. This process determines how costs get shared between health & auto insurance plans. Understanding this process can maximize coverage while minimizing outofpocket expenses.

Individuals must inform insurance providers about all applicable policies. Consequently. Transparency streamlines coordination efforts. Clarifying which provider pays first. Knowing how this process works can alleviate financial burdens during recovery.

Moreover. Specific rules govern how benefit payments apply. Certain insurance companies prioritize auto claims. While others focus on health costs. Being proactive in understanding coordination policies leads To better overall management of recovery finances.

SelfPay Options & Negotiations

Some individuals may face situations where relying solely on insurance proves inadequate. In such cases. Selfpay options may become an attractive alternative. Discussing expenses with providers can lead To negotiated rates & payment plans.

Advocating for oneself during these discussions often yields better financial outcomes. Many providers are open To negotiation. Especially when facing uncertain payment timelines. Diligently pursuing dialogue on costs can create affordable payment arrangements.

Furthermore. Certain healthcare providers offer discounts for upfront payments. Exploring selfpay options ensures individuals can access necessary care without financial strain. Therefore. Exploring all avenues enables comprehensive & flexible treatment planning.

Impact of State Regulations on Coverage

State regulations significantly influence health insurance coverage. Different states impose diverse mandates on insurance providers. Shaping what must get covered. Recognizing these regulations helps individuals understand their rights while seeking medical assistance postaccident.

States may dictate mandatory coverage levels for personal injury protection options. These regulations vary. Meaning individuals must be aware of local laws governing such requirements. Moreover. States could have specific protections related To emergency services. Influencing overall care impact.

Individuals researching insurance plans should consider statespecific nuances. Enhancements To coverage in certain states may offer advantages. Leading To better recovery experiences. By staying informed about regulations. Individuals can secure proper assistance following car accidents.

Choosing The Right Health Insurance Plan

Evaluating health insurance options becomes essential for anyone driving. Individuals should assess potential coverage needs specific To car accidents. Compare various plans. Noting their benefits. Limitations, & outofpocket responsibilities.

Consulting with insurance agents may offer clarity about different options available. Agents can address questions & provide valuable insights into policies tailored for specific needs. Being wellinformed ensures individuals select comprehensive plans capable of supporting recovery.

Additionally. Seeking recommendations from friends or family can yield personal experiences. Based on firsthand accounts. Individuals can identify worthwhile options. Trustworthy referrals often lead To better overall management of health insurance coverage.

Maximizing Your Coverage

- Review policy regularly for updates 📑

- Communicate clearly with providers 📞

- Utilize preventive care services 🩺

- Keep all medical records organized 🗂️

- Ask about discounts for treatments 💸

- Understand each coverage tier 🏷️

- Seek legal advice if complicated 🚨

Additional Resources & Support

Finding relevant resources can aid in navigating health insurance challenges. Many nonprofit organizations provide educational materials about car accidents & insurance. These organizations often host workshops & seminars designed To help individuals understand their rights.

Moreover. Leveraging online platforms can lead individuals toward valuable tools. Various websites & forums offer insights into specific policies. Experiences, & recommendations. Today’s digital landscape fosters access To essential information for affected individuals.

Networking within local communities or support groups can also provide muchneeded encouragement. Other individuals who faced similar situations can share their journeys. Offering insights. Having a support system can make a profound difference during recovery.

Legal Considerations & Assistance

In certain cases. Individuals may need legal assistance regarding health insurance claims. Navigating negotiations with insurance companies can become complex & daunting. Understanding legal rights plays a key role in ensuring proper representation.

Consulting with qualified lawyers experienced in health insurance matters can provide essential guidance. These professionals often help individuals understand intricacies within their policies & any appeals necessary. Seeking legal counsel ensures individuals handle disputes effectively.

Additionally. Knowing when legal representation becomes necessary empowers individuals. Certain signs. Such as claim denials or unreasonable offers. Warrant consultation. Empowering oneself with knowledge leads To better decisions regarding recovery.

Understanding Health Insurance Coverage

Health insurance varies by provider & plan type. Coverage includes various medical expenses. Many individuals wonder about specific situations. Car accidents are one such scenario. Most plans cover injuries that occur in these incidents.

Knowing what benefits your policy offers helps. Coverage might include hospital bills. Doctor visits, & rehabilitation. Always review coverage details before needing care. Every detail matters during recovery. You don’t want surprise expenses later.

Additionally. Consult with your insurance agent. Ask questions regarding specifics on coverage after an accident. Ensure you understand deductibles. Copays, & limits. These factors significantly impact outofpocket costs.

Types of Coverage Available

Health insurance coverage can vary significantly. Two primary types often come into play: personal injury protection (PIP) & liability insurance. Personal injury protection covers your medical bills. Regardless of who caused an accident. Liability insurance. However. Covers another person’s medical costs if you caused The incident.

PIP usually offers broader coverage than alternative options. This coverage pays for medical costs & lost wages. Individuals may find this helpful since recovery takes time. Understanding each plan’s nuances helps with informed decisionmaking.

To learn more. Check expert guidance on using health insurance for a car accident injury here. Another resource, this one. Clarifies specifics related To Florida insurance laws.

Understanding Policy Details

Reviewing policy details postaccident may seem daunting. Familiarize yourself with coverage types early. This knowledge prepares you for emergencies. Look for clauses regarding exclusions & limitations.

Coverage often depends on various factors. More comprehensive plans provide better assistance. In contrast. Limited plans might not cover all injuries. Understanding your individual policy enhances awareness.

When in doubt. Seek help from officials or trusted insurance agents. Their expertise clarifies complicated terms & conditions. Avoid making decisions without understanding policy details thoroughly.

How Claims Work

Filing a claim follows certain steps. First. Gather necessary documentation. This includes accident reports. Medical records, & other relevant information. These documents support your claims process.

Next. Contact your insurance provider. Explain what happened during an accident. Providing accurate information helps streamline The claims process. Each company has distinct requirements for filing claims.

Expect claims processing times To vary. Timely submission of documents facilitates faster approvals. Additionally. Consider following up if delays occur. Persistence often results in quicker resolutions.

Dealing with Exclusions & Limitations

Many insurance policies contain exclusions. Be aware of what falls outside coverage. For instance. Cases involving intoxication or reckless driving typically get excluded. Reading through The fine print helps avoid surprises later.

Another common exclusion involves preexisting conditions. If an injury relates back To a prior situation. Coverage may not apply. Understanding these nuances plays an essential role in filing claims.

Always question insurance agents about potential pitfalls. Identifying coverage limitations allows a strategic approach. A proactive mindset helps navigate challenges efficiently.

Costs Associated with Treatment

Medical care costs vary from one provider To another. Most individuals face significant medical bills after a car accident. Coverage details determine outofpocket expenses. Higher deductibles often lead To increased financial pressure.

Many plans cover a portion of medical expenses. Copayments may apply for doctor visits or treatment sessions. Understanding these costs upfront assists in budgeting for care.

In emergencies. It’s crucial To seek immediate medical attention. Delays can exacerbate injuries & increase costs. Fast. Appropriate actions lead To better health outcomes.

Comparing Coverage Options

| Type of Insurance | Coverage Flexibility | Average Premiums | 🔍Pros | ❌Cons |

|---|---|---|---|---|

| PIP | High | Moderate | Covers your expenses | May not cover others’ costs |

| Liability | Moderate | Low | Good for shared costs | Limited individual expense coverage |

| Health Insurance | Variable | High | Broader medical coverage | Complex claim process |

Personal Experiences

In my own situation. I faced a car accident recently. Navigating insurance claims proved challenging yet enlightening. I learned about various coverage aspects firsthand. This knowledge proved advantageous during recovery & claim processing. Always expect uncertainties. But preparation pays off.

Resources for Further Assistance

Seeking additional information helps navigate insurance options. Local agencies often provide resources explaining coverage. Online forums allow interactions with others facing similar challenges. Many people share experiences & advice regarding claims & medical needs.

Additionally. Various websites offer insights into policies & regulations. Keeping up with updates ensures informed decisions. Regularly researching changes allows adapting strategies accordingly. Stay proactive throughout your insurance journey.

Join online groups for discussions about experiences. Networking with individuals provides support during difficult circumstances. Involving yourself in communities enriches your understanding.

Final Thoughts

Understand health insurance intricacies relevant To vehicle accidents. Knowledge empowers individuals during stressful situations. Each aspect affects financial responsibilities after injuries occur.

Stay informed about specific coverage aspects. Grasping differences among plans ensures better preparation. This understanding positively impacts decisionmaking in emergencies. Knowledge truly serves as a powerful tool.

Lastly. Advocate for your needs during recovery. Research. Ask questions, & keep communication open with insurers. Such actions pave a smoother path whenever navigating health insurance challenges.

For more wellness insights & resources. Don’t forget To check this link.

What should I do immediately after a car accident?

After a car accident. Ensure everyone’s safety first & call for emergency services if needed. Exchange information with The other driver. Including insurance details. Document The accident scene by taking photographs & writing down witness statements.

Will my health insurance cover injuries from a car accident?

Health insurance typically covers medical expenses related To injuries sustained in a car accident. However. Coverage can vary greatly. So it’s essential To review your specific policy & consult with your insurance provider.

What types of medical expenses can health insurance cover after a car accident?

Health insurance can cover a variety of medical expenses. Including hospital bills. Surgeries. Rehabilitation, & followup care associated with accidentrelated injuries. Always check your policy for specific coverage details.

Do I need To file a claim with my health insurance after a car accident?

Yes. It’s generally advisable To file a claim with your health insurance as soon as possible. This ensures that your medical expenses are covered, & you can also coordinate with your car insurance for additional coverage.

What if The other driver is at fault?

If The other driver is at fault. Their liability insurance may cover your medical expenses. However. Your health insurance may still be billed first, & you might need To seek reimbursement from The atfault driver’s insurance later.

How does nofault insurance work in relation To health insurance?

Nofault insurance allows you To claim medical expenses directly from your own insurance. Regardless of who was at fault. It typically covers medical bills & lost wages without needing To pursue a claim against The other driver.

Can I use my health insurance To pay for rehabilitation after an accident?

Yes. Most health insurance plans will cover rehabilitation services if they are deemed medically necessary following a car accident. Check your policy for specific coverage limitations & requirements.

What should I do if my health insurance claim is denied?

If your health insurance claim is denied. Review The denial letter for reasons. You can often appeal The decision by providing additional documentation or clarification regarding The treatment related To your accident.

How does health insurance coordinate with auto insurance?

Health insurance & auto insurance may coordinate benefits through a process called subrogation. This allows your health insurer To recover costs from The atfault driver’s insurance if you have already received medical treatment related To The accident.

Are there any limitations To health insurance coverage for car accident injuries?

Yes. Limitations may include exclusions for certain types of injuries. Caps on benefits. Or requirements for preauthorization. It’s essential To familiarize yourself with your policy’s terms & conditions.

Will my premiums increase if I file a health insurance claim for a car accident?

Filing a claim for a car accident may not directly impact your health insurance premiums. But if other factors are considered (like new risk assessment). It could potentially influence your rates in The future.

What documents do I need To provide when filing a claim?

When filing a claim. You will typically need To provide your insurance policy number. Accident details. Medical invoices, & any other documentation supporting your claim. Always refer To your insurer’s guidelines for specifics.

Can I choose my medical provider after a car accident?

In most cases. You have The right To choose your medical provider following a car accident. However. Some insurance plans may require you To see a specific provider or obtain referrals for certain types of care.

Is there a time limit for filing a health insurance claim after an accident?

Yes. There are often time limits for filing health insurance claims after an accident. Generally. You’ll need To file within a certain number of days from The date of The accident or The date of treatment. Check your policy for specific timelines.

Will health insurance cover mental health treatment after a car accident?

Many health insurance plans provide coverage for mental health services. Including therapy for emotional distress following a car accident. Ensure you understand your policy & any requirements for coverage.

Conclusion

Understanding health insurance coverage for car accidents is essential for your peace of mind. It’s crucial To know what your policy covers & what it doesn’t, so you’re not caught off guard after an accident. Remember, your health insurance can help with medical bills, but it may not cover everything related To The accident. Always check with your insurance provider & ask questions To clarify any doubts. Staying informed will help you navigate The aftermath of a car accident more easily. Being prepared can make a big difference in your recovery & financial well-being. Stay safe & drive carefully!